Helpful tips for getting ready to file your taxes

TurboTax discounts

RGCU members can save 20% on TurboTax® federal products. Learn more.

H & R Block discounts

RGCU members can save up to $25 on tax preparation. Learn more.

Guide to Filing Taxes

Download Your Complete Guide to Filing Taxes here.

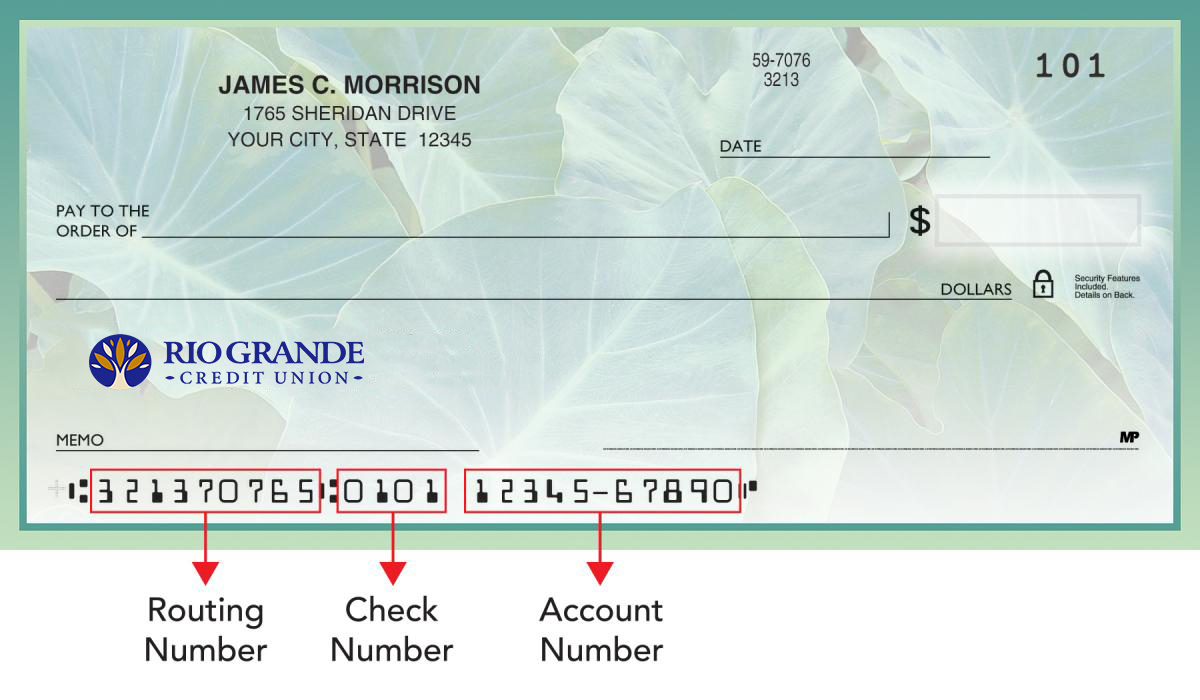

Routing number

RGCU's routing number is: 307083678

Taxpayer Resources

IRA contributions

Make the most of your retirement savings by contributing the maximum yearly limit to your IRAs. For the 2020 and 2021 tax years, you can contribute a total of $6,000 to Traditional or Roth IRAs. If you are over age 50, you can contribute an additional $1,000 “catch-up” contribution.

Please submit your IRA contribution in advance of the tax filing deadline to allow plenty of time to complete the necessary paperwork. IRA contributions for 2020 can be made until the tax filing deadline in April 2021. Please consult your tax advisor or financial advisor with questions about your individual tax circumstances.

If you don’t have an IRA, get started today. RGCU offers traditional or Roth IRAs, Education Savings Accounts, and IRA Certificates. Learn more here.

Deposit your tax refund

No one likes standing in line just waiting to deposit a check. Avoid the hassle and have your check automatically deposited into your account. Direct deposit is a free electronic transfer service you can use to send your paychecks directly to your RGCU checking or savings account.

Direct Deposit Benefits

- It's convenient. Eliminates the need to deposit checks in person.

- It's safer. Reduces risk of lost or stolen checks.

- It's faster. Get direct access to your money on payday.

- It's flexible. You can divide your funds across multiple accounts.

How to Set up Direct Deposit

You'll need to ask your employer for their direct deposit form and include the following:

- RGCU's ABA/routing number: 307083678

- Your 10-digit checking or savings account number. It can be found in the Account Summary tab of Online Banking, on your statement, and at the bottom of each check. Your checking account number will be different from your savings number.

Note:

You may be asked to include a voided check. If this is the case, simply write VOID across the front of check and attach to any direct deposit paperwork. If you don't have checks, we'd be happy to draft you a direct deposit letter you can give to your employer. If you get federal benefits, you can find a federal direct deposit form on the US General Services Administration website.

Tax Preparation Checklist

Whether you are preparing your tax returns yourself or going to a tax professional, it will save time and aggravation if you have certain information gathered before you start. Use this handy checklist to help you put together the right information.

Personal data

- Social Security numbers (including spouse and children

- Child care providers: Name, address and tax I.D. or Social Security Number

- Alimony Paid: Social Security Number

Employment and income data

- W-2 forms

- Unemployment compensation: Forms 1099-G

- Miscellaneous income including rent: Forms 1099-MISC

- Partnership, S Corporation, & trust income: Schedules K-1

- Pensions and annuities: Forms 1099-R

- Social Security/RR1 benefits: Forms RRB-1099

- Alimony received

- Jury duty pay

- Gambling and lottery winning

- Prizes and awards

- Scholarships and fellowships

- State and local income tax refunds: Form 1099-G

Homeowner/renter data

- Residential address(es) for this year

- Mortgage interest: Form 1098

- Sale of your home or other real estate: Form 1099-S

- Second mortgage interest paid

- Real estate taxes paid

- Rent paid during tax year

- Moving expenses

Financial assets

- Interest income statements: Form 1099-INT & 1099-OID

- Dividend income statements: Form 1099-DIV

- Proceeds from broker transactions: Form 1099-B

- Retirement plan distribution: Form 1099-R

Financial liabilities

- Auto loans and leases (account numbers and car value) if vehicle used for business

- Student loan interest paid

- Early withdrawal penalties on CDs and other time deposits

Automobiles

- Personal property tax information

Expenses

- Gifts to charity (qualified written statement from charity for any single donations of $250 or more)

- Un-reimbursed expenses related to volunteer work

- Un-reimbursed expenses related to your job (travel expenses, uniforms, union dues, subscriptions)

- Investment expenses

- Job-hunting expenses

- Job-related education expenses

- Child care expenses

- Medical Savings Accounts

- Adoption expenses

- Alimony paid

- Tax return preparation expenses and fees

Self-employment data

- Business income: Forms 1099-MISC and/or own records

- Partnership SE income: Schedules K-1

- Business-related expenses: Receipts, other documents & own records

- Farm-related expenses: Receipts, other documents & own records

- Employment taxes & other business taxes paid for current year: Payment records

Miscellaneous Tax Documents

- Federal, state and local estimated income tax paid for current year: Estimated tax vouchers, cancelled checks and other payment records

- IRA, Keogh and other retirement plan contributions: If self-employed, identify as for self or employees

- Records to document medical expenses

- Records to document casualty or theft losses

- Records for any other expenditures that may be deductible

- Records for any other revenue or sales of property that may be taxable or reportable